Due to a ransomware attack at a hosting provider Munters releases preliminary fourth quarter and full year results 2023

Jan 21, 2024

Due to a ransomware attack at one of Munters hosting providers, Tietoevry, it cannot be ensured, that information regarding Munters preliminary results for the fourth quarter and full year 2023 has remained confidential. Therefore, Munters is releasing a summary of this ahead of the full year report on February 1, 2024. Currently, Munters financial consolidation system and a limited part of our business systems are affected by the ransomware attack. Munters is in continuous dialogue with Tietoevry regarding the situation. There is currently no forecast for when the issues can be fully resolved.

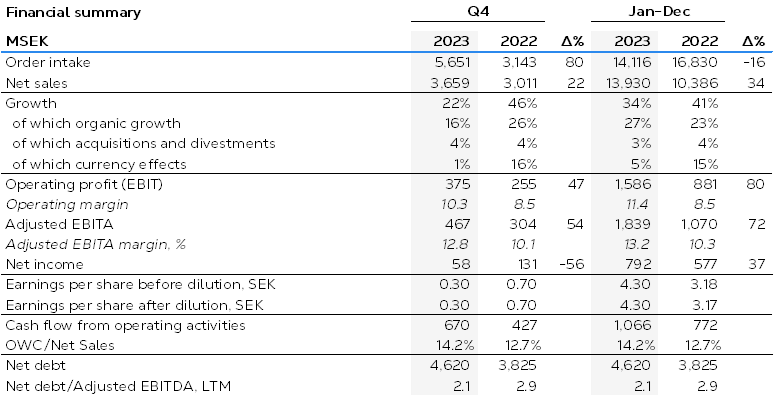

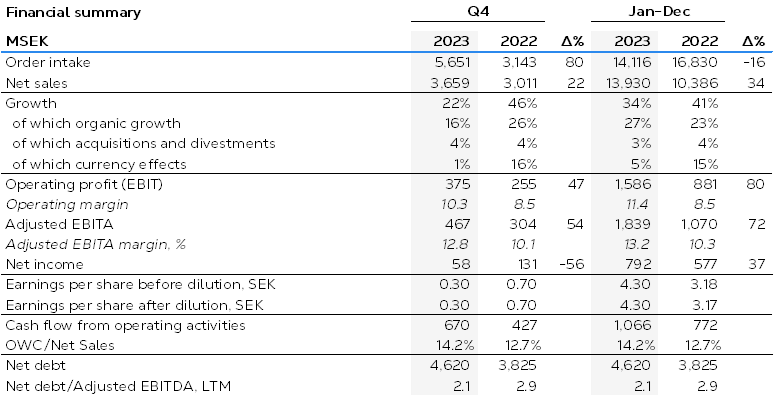

Summary of the fourth quarter 2023:

-

Munters reports a strong quarter with increased order intake and net sales, a strengthened adjusted EBITA-margin and a lower leverage.

-

Order intake increased organically +82%, MSEK 5,651 (3,143).

-

Net sales increased organically +16%, MSEK 3,659 (3,011).

-

Adjusted EBITA amounted to MSEK 467 (304), corresponding to an adjusted EBITA-margin of 12.8% (10.1).

-

Net income for the period decreased to MSEK 58 (131) due to an increase in financial and tax expenses as well as additional IACs from restructuring and M&A activities.

-

Cash flow from operating activities amounted to MSEK 670 (427). Cash flow from changes in working capital had a positive impact of MSEK 389 (189) in the quarter.

-

Net debt in relation to adjusted EBITDA was 2.1x compared to 2.2x at end of September 2023 and 2.9 at end of December 2022. Net debt as of December 31, 2023 amounted to MSEK 4,620 compared to MSEK 4,399 at the end of September 2023 and MSEK 3,825 at the end of December 2022.

Summary of the full year 2023:

-

Order intake decreased organically -21%, MSEK 14,116 (16,830).

-

Net sales increased organically +27%, MSEK 13,930 (10,386).

-

Adjusted EBITA amounted to MSEK 1,839 (1,070), corresponding to an adjusted EBITA-margin of 13.2% (10.3).

-

Net income for the period amounted to MSEK 792 (577).

-

Cash flow from operating activities amounted to MSEK 1,066 (772).

Note: All figures relating to 2023 in this press release are preliminary and unaudited. The final report for the fourth quarter of 2023 will be published on February 1, 2024 at 07.30 CET. Definitions of key figures see page 4.

“Munters views the incident at Tietoevry very seriously and is in close contact with them. In summary, we report a strong result for 2023 and I look forward to presenting and commenting the results in more detail on February 1 when we release the full year results”, says Munters CEO and President, Klas Forsström.

Munters does not intend to communicate any further information regarding the fourth quarter or full year 2023 results before publishing the full year report for 2023 on Thursday, February 1, 2024 at 07:30 CET. Please see the invitation details to the conference call below.

On February 1, at 07.30 CET, Munters will release the year-end report 2023.

Media, investors and analysts are on the same day invited to attend a presentation of the report at 09.00 CET. The President and CEO, Klas Forsström, together with the Group Vice President and CFO, Katharina Fischer will present the report in a webcast with telephone conference.

Webcast:

If you wish to participate via webcast please use the link below. Via the webcast you are able to ask written questions.

https://ir.financialhearings.com/munters-q4-report-2023

Telephone conference:

If you wish to participate via teleconference, please register on the link below. After registration you will be provided with phone numbers and a conference ID to access the conference. You can ask questions verbally via the teleconference.

https://conference.financialhearings.com/teleconference/?id=5002920

For more information:

Investors and analysts

Ann-Sofi Jönsson, Vice President, Investor Relations & Enterprise Risk Management

E-mail: ann-sofi.jonsson@munters.com, Phone: +46 (0)730 251 005

Line Dovärn, Director, Investor Relations

E-mail: line.dovarn@munters.com, Phone: +46 (0)730 488 444

Media

Eva Carlsson, Director External Communications

E-mail: eva.carlsson@munters.com, Phone: +46 (0)70 88 33 500

This disclosure contains information that Munters is obliged to make public pursuant to the EU Market Abuse Regulation (EU nr 596/2014). All figures relating to 2023 in this press release are preliminary and unaudited. The information was submitted for publication, through the agency of the contact persons, on January 22, 2024, at 00:45 CET.

Definition of key financial indicators:

Organic growth: Change in net sales compared to the previous period, excluding acquisitions and divestments and currency translation effects. The measure is used by Munters to monitor net sales growth driven by changes in volume and price between different periods.

Order backlog: Received and confirmed sales orders not yet delivered and accounted for as net sales. Order Backlog is a useful measure to indicate the efficiency of the conversion of received and confirmed sales orders into net sales in future periods. The measure is used by Munters to monitor business performance and customer demand and adjust operations if needed.

Order intake: Received and confirmed sales orders minus cancelled orders during the reporting period. The order intake is an indicator of future revenues and, consequently, an important KPI for the management of Munters’ business.

Operating profit (EBIT): Earnings before interest and tax. Munters believes that EBIT shows the profit generated by the operating activities.

Adjusted EBITA: Operating profit, adjusted for amortizations, write-downs of intangible assets and items affecting comparability. Munters believes that using adjusted EBITA is helpful in analyzing our performance as it removes the impact of items considered not to be of recurring character and therefore do not reflect our core operating performance.

Adjusted EBITA margin: Adjusted EBITA as a percentage of net sales. Munters believes that Adjusted EBITA margin is a useful measure for showing the Company’s profit generated by the operating activities.

Adjusted EBITDA: Operating profit adjusted for items affecting comparability and depreciations, amortizations and write-downs of tangible and intangible assets as well as Right-of-Use assets.

Adjusted EBITDA margin: Adjusted EBITDA as a percentage of net sales.

Items affecting comparability (IAC): Items affecting comparability are events or transactions with significant financial effects, which are relevant for the understanding of the financial performance when comparing the current period to previous periods. Items included are for example, restructuring activities, capital gains and losses from business divestments and M&A related costs.

LTM: LTM (last twelve months) after any key indicator means that the KPI corresponds to an accumulation of previous twelve month reported numbers. The measure highlight trends in different KPIs, which is valuable in order to gain a deeper understanding of the development of the business.

Net debt: Net debt calculated as interest bearing liabilities, lease liabilities, provisions for pension and accrued financial expenses, reduced by cash and cash equivalents.

Operating working capital: Includes accounts receivable, inventory, accrued income, accounts payable and advances from customers.

Operating working capital/net sales: Average Operating Working Capital for the last twelve months as a percentage of Net sales for the same period.

Earnings per share: Net income divided by the weighted average number of outstanding shares.

About Munters Group

Munters is a global leader in energy-efficient air treatment and climate solutions. Using innovative technologies, Munters creates the perfect climate for customers in a wide range of industries. Munters has been defining the future of air treatment since 1955. Today, around 4,000 employees carry out manufacturing and sales in more than 30 countries. Munters Group AB reported annual net sales of more than SEK 13 billion in 2023 and is listed on Nasdaq Stockholm. For more information, please visit www.munters.com.

Munters Press release 22 January 2024

3912914_0.png